What Every Namibian Student and Entry-Level Professional Should Know About the Upstream Oil & Gas Sector

The upstream oil and gas industry in Namibia is no longer a theoretical possibility—it is a rapidly developing reality. Since 2022, a series of landmark discoveries in the offshore Orange Basin have shifted the country’s status from a marginal frontier to one of the most closely watched exploration zones globally. For students and early-career professionals in Namibia, this marks a rare national moment: an emerging industry with multi-decade potential, unfolding in real time.

This insight offers a breakdown of the current state of upstream oil and gas in Namibia and explains what it means for the next generation of Namibian talent.

The Industry Has Shifted: From Exploration Graveyard to Global Hotspot

Namibia spent decades as a frontier market in oil and gas exploration. While interest existed, no commercial discoveries materialized—until Shell’s Graff-1X and TotalEnergies’ Venus-1X wells redefined the country’s trajectory in 2022. These finds were not just symbolic; they signaled multi-billion-barrel potential, especially when Galp Energia’s Mopane complex added another significant discovery to the list in 2023.

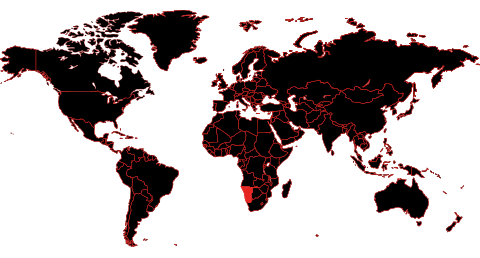

Today, Namibia’s offshore basins—particularly the Orange Basin—are attracting the attention of the world’s largest and most experienced oil companies. Shell, TotalEnergies, Galp, Chevron, ExxonMobil, and QatarEnergy are all actively involved. But the country is still in a pre-production phase, and that distinction matters.

As of early 2025, Namibia has not yet produced a single commercial barrel of oil. Exploration and appraisal continue, and all major discoveries are undergoing technical reviews to confirm how much of the oil can be commercially extracted. First production is projected around 2029–2030, if key milestones like Final Investment Decisions (FIDs) are met.

What Does This Mean for You as a Student or Young Professional?

This period—between discovery and production—is the entry window for the local workforce. While senior roles are typically held by technical experts from established oil economies, the foundational structure for local hiring, training, and workforce development is being built now.

The Namibian government’s National Upstream Local Content Policy mandates that operators hire, train, and partner with Namibians wherever possible. That means:

New hiring pipelines will be created in the coming years

Skills development programs and scholarships will expand

Entry-level roles in logistics, technical services, health and safety, and project support will grow in demand

Mid-term roles in operations, maintenance, monitoring, and regulatory compliance will follow as production ramps up

This is a sector where the first five years of your career—what you learn, where you work, and what skills you acquire—will directly shape your long-term opportunities. And for Namibia, this will be the first generation of talent to help define the character, standards, and culture of its energy workforce.

Understanding the Structure: Where Work Will Come From

The upstream oil and gas value chain includes distinct phases of work, each demanding different profiles of labor and expertise. Here’s a simplified outline relevant to student and graduate career planning:

Exploration and Appraisal (Current Phase)

Seismic surveys, well testing, reservoir evaluation

Entry points: junior geoscience assistants, data analysts, environmental support staff, HSE interns, logistics coordinators

Development Planning and FID (2025–2026)

Conceptual engineering, infrastructure design, financial modeling, procurement planning

Entry points: engineering interns, finance and compliance roles, administrative and contract support

Field Development and Construction (2026–2028)

Installation of subsea infrastructure, floating production units (FPSOs), onshore port upgrades

Entry points: construction safety officers, junior field technicians, marine logistics teams

Production Operations (2029 onward)

Day-to-day oil and gas extraction, monitoring, maintenance, crew management, offshore support

Entry points: control room assistants, offshore technicians, compliance monitoring officers

Across all phases, support services—from catering and transport to IT, accounting, and legal review—will play a key role. Not all jobs will be offshore, and not all will require engineering degrees. But all will require adaptability, technical awareness, and the ability to work in high-standard environments.

A Sector Defined by Technical Complexity and Capital Discipline

Namibia’s oil finds are not simple to develop. Most discoveries are in ultra-deepwater (2,000–3,000 meters), which means production will involve advanced floating infrastructure, remote operations, and complex gas handling systems. These are high-stakes projects, and commercial success is not guaranteed.

Shell, for example, recently wrote down over $400 million in investments in its Orange Basin assets, citing commercial uncertainty. That does not signal collapse, but it does underline a key lesson: not every discovery results in a producing field. This is a capital-intensive sector, and only the most technically and economically viable projects will move forward.

For students, this highlights the importance of skills that match global standards. Being Namibian is not enough. The industry requires talent that is trained, certified, safety-conscious, and professionally prepared to operate under pressure.

What Skills Are Becoming Essential?

The upstream sector is technical at its core. But it also needs project managers, environmental scientists, operations assistants, and safety personnel. Based on the current needs across development zones, here are skills and competencies that will be in high demand:

Technical Foundations: engineering (mechanical, electrical, petroleum), geology, instrumentation, welding, surveying

Digital Literacy: data entry and visualization, control systems, reporting tools, logistics platforms

Regulatory and Compliance Knowledge: environmental monitoring, permit tracking, documentation

Soft Skills: communication, teamwork, project coordination, resilience in remote or high-pressure environments

Certifications: BOSIET, HSE Level 1 & 2, offshore medical fitness, marine logistics handling, procurement training

It is crucial that training institutions, whether universities or vocational academies, adapt to meet these sector-specific needs. Students should take initiative to pursue certification programs where possible and actively seek out internships in oil-adjacent industries.

Final Word: Positioning Yourself in a Changing Industry

Namibia’s upstream oil and gas sector is not a distant dream—it is a complex, high-value industry under active construction. While the spotlight is currently on international operators and billion-dollar discoveries, the long-term foundation of the industry will be built on the quality of its local workforce.

If you are a student or young professional today, you are in a unique position. You have time to prepare. You have time to specialize. And you have the opportunity to enter a sector at the beginning of its development cycle.

At Lelo Energies, we believe in building a Namibian workforce that is not just involved—but indispensable. We are committed to preparing young people to meet this opportunity with clarity, discipline, and ambition.

To support this mission, we are hosting the Lelo Energies Student Conference 2025, designed to help students and early professionals explore industry entry points, understand where the sector is headed, and connect with experts shaping Namibia’s energy future.

Early registration is now open. Take the step that aligns your career path with the country’s energy future.

Earth Day 2025 – Our Power, Our Planet

“Our Power, Our Planet” — the theme of Earth Day 2025 — is not just a rallying cry for envir

Positioning Namibia’s Youth at the Center of Its Energy Future

Namibia stands at a pivotal moment in its national development, faced simultaneously with a signific

What Every Namibian Student and Entry-Level Professional Should Know About the Upstream Oil & Gas Sector

The upstream oil and gas industry in Namibia is no longer a theoretical possibility—it is a rapidl